Get QuickBooks Online Plans starting at $30 per month. Step 2. Sign up for Bill Pay. Pick

Online Bill Pay

Are you tired of dealing with piles of paper invoices and checks? Do you struggle to keep track of your business expenses? Look no further! QuickBooks Bill Pay is here to help you streamline your payment process and take your business to the next level.

With QuickBooks Bill Pay, you can easily pay your vendors and contractors, keep track of your bills and payments, and even earn rewards in the form of cash back. It’s the perfect solution for small businesses looking to simplify their financial management processes.

In this article, we’ll explore the ins and outs of QuickBooks Bill Pay, including its features, pricing, and set-up process. We’ll also discuss the benefits of using this innovative payment solution and how it can help your business thrive.

What is QuickBooks Bill Pay?

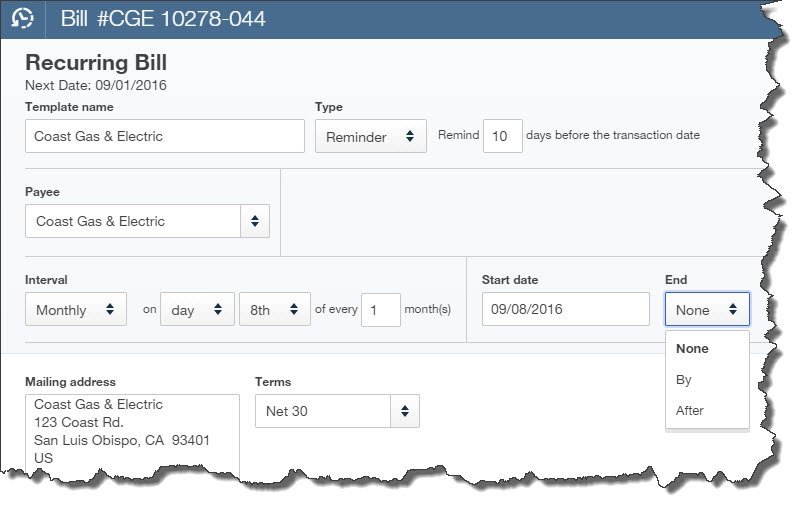

QuickBooks Bill Pay is a payment solution designed specifically for small businesses. It allows you to pay your vendors and contractors electronically, without the need for paper checks or manual bank transfers. With QuickBooks Bill Pay, you can schedule payments in advance, set up recurring payments, and even earn cash back on your purchases.

How does QuickBooks Bill Pay work?

QuickBooks Bill Pay works by connecting your QuickBooks account to your bank account. Once connected, you can easily import bills from your vendors and contractors, schedule payments, and track your expenses. You can also set up recurring payments for regular bills, such as rent or utilities.

When you pay a bill using QuickBooks Bill Pay, the funds are deducted from your bank account and transferred to the vendor’s account. You’ll also receive confirmation of the payment, so you can rest assured that your bills have been paid on time.

Features of QuickBooks Bill Pay

QuickBooks Bill Pay offers a range of features that make it an attractive payment solution for small businesses. Here are some of the key benefits:

1. Easy payment processing

With QuickBooks Bill Pay, you can easily pay your vendors and contractors electronically. No more writing checks or manually transferring funds. You can also schedule payments in advance, so you don’t have to worry about missing a payment.

2. Cash back rewards

QuickBooks Bill Pay offers cash back rewards on your purchases. You can earn up to 1.5% cash back on your purchases, which can be a great way to offset your business expenses.

3. Automatic expense tracking

QuickBooks Bill Pay automatically tracks your expenses, so you don’t have to. You can easily see what you’re spending and where, which can help you make informed business decisions.

4. Recurring payments

With QuickBooks Bill Pay, you can set up recurring payments for regular bills, such as rent or utilities. This ensures that your bills are paid on time, every time.

5. Vendor management

QuickBooks Bill Pay allows you to manage your vendors and contractors easily. You can store their payment information securely, so you don’t have to worry about lost or misplaced invoices.

Pricing for QuickBooks Bill Pay

QuickBooks Bill Pay offers three pricing plans, so you can choose the one that’s right for your business. Here are the current pricing options:

1. Basic

The Basic plan costs $0/month and includes 5 free ACH payments per month. You’ll also get free bill tracking and alerts.

2. Premium

The Premium plan costs $15/month and includes 40 free ACH payments per month. You’ll also get features like automated bill creation, auto-match transactions, and unlimited 1099 filing.

3. Elite

The Elite plan costs $90/month and includes unlimited ACH payments. You’ll also get features like roles and permissions, bill approval workflows, and faster ACH processing.

How to set up QuickBooks Bill Pay

Setting up QuickBooks Bill Pay is easy. Here are the steps:

FAQ

How does QBO Bill Pay work?

How does the online Bill Pay work?

What are the payment methods in QBO?

Other Resources :

Learn about QuickBooks Bill Payquickbooks.intuit.com › online

Get QuickBooks Online Plans starting at $30 per month. Step 2. Sign up for Bill Pay. Pick