All banks and their clients can be targets of phishing emails. Pinnacle clients called in recently about a bill payment message addressed from “PNC Bank.

BillPay Email Scams

With the rise of online banking and electronic payments, bill pay email scams have become a significant concern for individuals and businesses alike. Phishing emails, in particular, have become a preferred method for scammers to trick people into divulging their personal and financial information. In this article, we will discuss the warning signs of bill pay email scams and provide tips on how to protect yourself from falling victim to these types of fraudulent activities.

Recognizing Phishing Emails

Phishing emails are designed to appear legitimate and often mimic the style and language used by financial institutions. However, there are several red flags that can help you identify a phishing email.

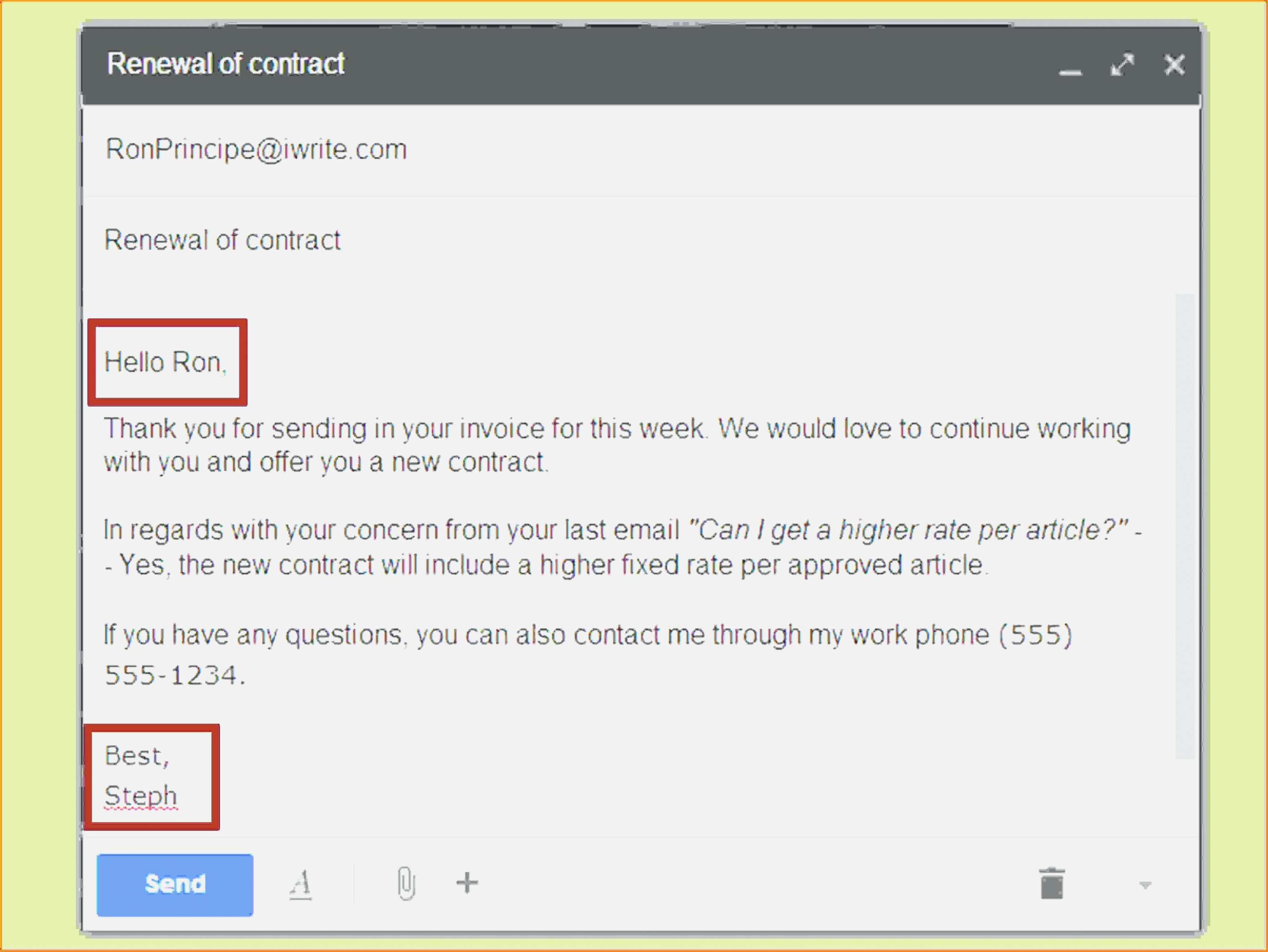

1. Check the sender’s email address

The sender’s email address may look similar to that of a legitimate financial institution, but there may be slight variations. Look out for misspellings, extra letters or numbers, or unusual characters in the email address.

2. Be wary of generic greetings

Phishing emails often use generic greetings such as “Dear customer” or “Hello there” instead of addressing you by your name.

3. Watch out for urgent or threatening language

Phishing emails often try to create a sense of urgency or fear to prompt you into taking action. Be cautious of emails that threaten to cancel your account or suggest that your information has been compromised if you don’t respond immediately.

4. Hover over links to see the URL

Before clicking on any links in an email, hover your mouse over the link to see the URL. If the URL looks suspicious or does not match the sender’s domain, do not click on it.

Protecting Your Information

To protect yourself from bill pay email scams, it is essential to be proactive and take the following steps:

1. Use updated antivirus software

Ensure that your computer and mobile devices have up-to-date antivirus software installed. This will help detect and protect against malware and other online threats.

2. Use strong and unique passwords

Use strong and unique passwords for all of your online accounts. Avoid using the same password for multiple accounts, and consider using a password manager to securely store your passwords.

3. Monitor your accounts regularly

Regularly monitor your bank and credit card statements for any suspicious activity. If you notice anything unusual, contact your financial institution immediately.

4. Use two-factor authentication

Enable two-factor authentication (2FA) on your accounts whenever possible. This adds an extra layer of security to your accounts, making it more difficult for scammers to gain access.

5. Avoid using public computers or networks

Avoid using public computers or networks to access your online accounts, especially for sensitive activities such as bill paying. Public computers may have malware installed, which could compromise your login credentials.

Conclusion

Bill pay email scams are a serious concern for individuals and businesses alike. By recognizing phishing emails and taking proactive steps to protect your information, you can avoid falling victim to these types of fraudulent activities. Remember to always be cautious when clicking on links or providing personal information online, and regularly monitor your accounts for any suspicious activity. Stay safe and protect your information by following the tips outlined in this article.

FAQ

Should I worry about a sextortion email?

Why would someone need my email for bank transfer?

Is it safe to send bank details by email?

Does Bank of America send out emails?

Other Resources :

All banks and their clients can be targets of phishing emails. Pinnacle clients called in recently about a bill payment message addressed from “PNC Bank.