You can make this payment in person, or by phone by calling the number on the back of your credit card. Check. You can send a check to the mailing address provided by your credit card issuer, but you’ll have to ensure the payment arrives by the due date. Mailing a check is one of the riskiest payment methods.

How To Pay A Credit Card Bill

As a credit cardholder, it’s essential to know how to pay your credit card bill on time to avoid late fees and potential damage to your credit score. In this article, we’ll guide you through the process of paying your credit card bill and provide you with the most accurate and up-to-date information from trusted sources.

Paying Your Credit Card Bill in Person or by Phone

One of the most convenient ways to pay your credit card bill is in person or by phone. You can make a payment in person at your credit card issuer’s branch or by calling the number on the back of your credit card. This method allows you to speak with a representative who can assist you with any questions or concerns you may have.

To pay your credit card bill in person or by phone, follow these steps:

- Gather your credit card and a valid form of identification, such as a driver’s license or passport.

- Visit your credit card issuer’s branch or call the number on the back of your credit card during business hours.

- Let the representative know that you’d like to make a payment. They’ll guide you through the process and provide you with the necessary information.

- Provide your credit card number, expiration date, and security code.

- Choose the payment method you’d like to use, such as a check, debit card, or bank transfer.

- Confirm the payment amount and any additional fees associated with the payment method.

- Verify your personal information to ensure the payment is processed correctly.

- Wait for the representative to process the payment and confirm that it has been successful.

Paying Your Credit Card Bill by Mail

Another option for paying your credit card bill is by mail. You can send a check to the mailing address provided by your credit card issuer, but it’s essential to ensure the payment arrives by the due date. Mailing a check is one of the riskiest payment methods, as it can take several days to arrive and may be lost or stolen in transit.

To pay your credit card bill by mail, follow these steps:

- Gather your credit card statement and a check or money order.

- Make the check or money order payable to the credit card issuer and include your credit card number in the memo field.

- Write the payment amount and date in the check or money order.

- Place the check or money order in an envelope and address it to the mailing address provided by your credit card issuer.

- Mail the envelope via certified mail with return receipt requested to ensure the payment is received and processed.

- Keep a record of the payment, such as a copy of the check or money order and the certified mail receipt.

Online Payment Methods

In addition to in-person and phone payments, many credit card issuers offer online payment methods. You can log in to your credit card account online and make a payment using a debit card, bank transfer, or check. This method is convenient and allows you to schedule recurring payments to ensure your bill is paid on time.

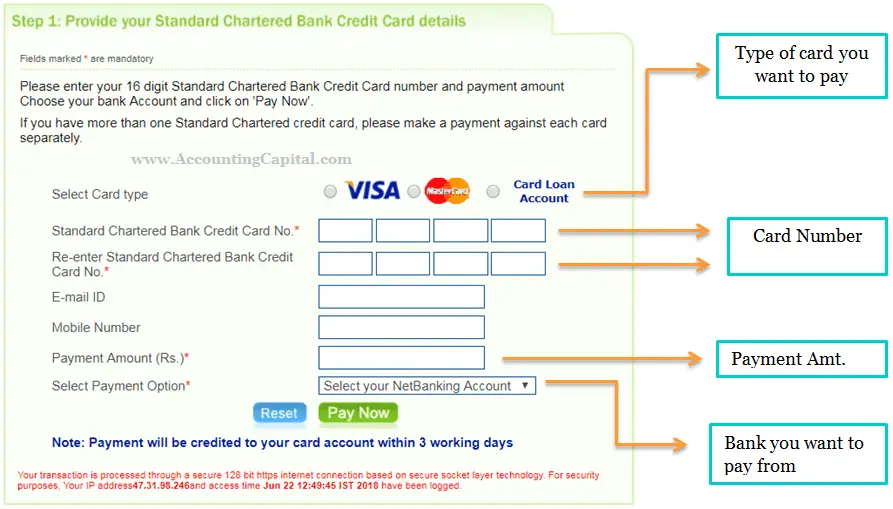

To pay your credit card bill online, follow these steps:

- Log in to your credit card account using your username and password.

- Navigate to the payment section and select the payment method you’d like to use.

- Enter the payment amount and any additional fees associated with the payment method.

- Verify your personal information to ensure the payment is processed correctly.

- Confirm the payment and wait for the transaction to process.

- Keep a record of the payment, such as a confirmation number or receipt.

Tips for Paying Your Credit Card Bill

Paying your credit card bill on time is crucial to avoid late fees and potential damage to your credit score. Here are some tips to help you make your payments successfully:

- Set up recurring payments to ensure your bill is paid on time, even if you forget.

- Choose a payment method that works best for you, such as in-person, by phone, by mail, or online.

- Keep a record of your payments to ensure you’ve made the payment and to dispute any errors.

- Avoid making payments by mail if possible, as it’s one of the riskiest payment methods.

- Contact your credit card issuer if

FAQ

How do people pay their credit card bills?

What is the safest way to pay a credit card bill?

Other Resources :

You can make this payment in person, or by phone by calling the number on the back of your credit card. Check. You can send a check to the mailing address provided by your credit card issuer, but you’ll have to ensure the payment arrives by the due date. Mailing a check is one of the riskiest payment methods.