Nov 19, 2020 · A bill pay service allows you to conveniently pay your bills online via mobile app or website, rather than sending a check by mail.What is bill pay? · How does bill pay work?

What Is Bill Pay and How Does It Work?

Introduction

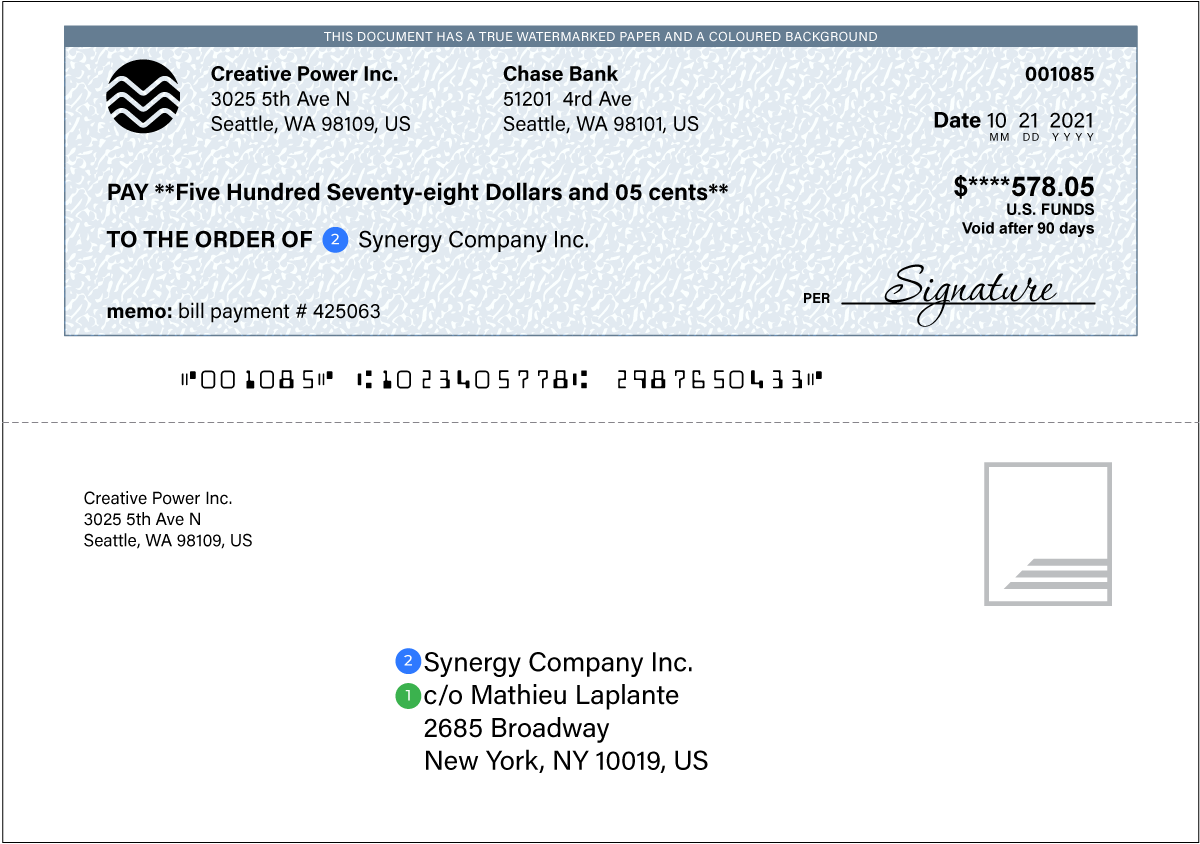

Bill pay check is a crucial aspect of personal finance, and it’s essential to understand how it works to avoid late payments and potential penalties. In this article, we’ll discuss the ins and outs of bill pay check and provide you with a comprehensive guide on how to make timely payments. We’ll also explore the different methods of bill payment and highlight the benefits of using online banking for this purpose.

Understanding Bill Pay Check

Bill pay check is a feature offered by banks and credit unions that allows you to pay your bills online or through mobile devices. This service is designed to simplify your payment process and save you time and effort. With bill pay check, you can:

- Pay bills online or through mobile devices

- Schedule recurring payments

- Set up automatic payments

- View payment history

- Receive alerts for payment due dates and past-due bills

Benefits of Bill Pay Check

There are several benefits of using bill pay check, including:

- Convenience: You can pay your bills anytime, anywhere, using your computer or mobile device.

- Time-saving: Bill pay check eliminates the need to write checks, mail payments, or visit a physical location.

- Accuracy: The payment amount is automatically deducted from your account, ensuring accurate payments.

- Security: Your personal and financial information is protected through secure online connections.

- Flexibility: You can schedule recurring payments, set up automatic payments, and view your payment history.

How to Make a Bill Pay Check

Making a bill pay check is straightforward. Here’s a step-by-step guide on how to do it:

- Enroll in Online Banking

To use bill pay check, you need to enroll in online banking. Visit your bank’s website and follow the enrollment process. Once you’ve enrolled, you can access your account and start paying bills online.

- Add Your Payees

After enrolling in online banking, you need to add your payees. A payee is the person or business you want to pay. You can add a payee by providing their name, address, and account number. You can also add a payee by using the bank’s database, which contains a list of commonly used payees.

- Schedule a Payment

Once you’ve added your payee, you can schedule a payment. You can choose the payment date, payment amount, and the account you want to use for the payment. You can also set up recurring payments for regular bills, such as utility bills or credit card payments.

- Review and Confirm

Before making a payment, review the payment details to ensure everything is correct. Once you’ve confirmed the payment, the bank will process the payment and send the funds to the payee.

- View Payment History

After making a payment, you can view your payment history to see the payment status and the payment date. You can also view your payment history to ensure that the payment was processed correctly.

Common Questions About Bill Pay Check

Here are some common questions about bill pay check:

- Q: Is there a fee for using bill pay check?

A: Some banks may charge a fee for using bill pay check, but many banks offer this service for free. Check with your bank to see if they charge a fee. - Q: Can I use bill pay check to pay any bill?

A: Yes, you can use bill pay check to pay any bill that can be paid through online banking. This includes utility bills, credit card bills, loan payments, and more. - Q: How long does it take for the payee to receive the payment?

A: The payment processing time varies depending on the bank and the payee. Some payees may receive the payment within one business day, while others may take several days. Check with your bank to see their processing times. - Q: Can I stop a payment?

A: Yes, you can stop a payment if it hasn’t been processed yet. Log in to your online banking account, find the payment, and cancel it. If the payment has already been processed, you’ll need to contact your bank to request a stop payment.

Conclusion

Bill pay check is a convenient and secure way to pay your bills online or through mobile devices. By

FAQ

What is a bill pay check?

Why did bill pay send a check?

What is bill pay on a checking account?

Is bill pay safer than check?

Other Resources :

Nov 19, 2020 · A bill pay service allows you to conveniently pay your bills online via mobile app or website, rather than sending a check by mail.