An ACH payment is a payment sent via the ACH (Automated Clearing House) network, an electronic network used to send paperless payments between bank accounts in the United States. If you think of payments as the money taken out of your account when you have your monthly bills on autopay – that’s typically done via ACH.

How to make an ACH payment

Introduction

ACH bill pay is a convenient and secure way to make payments electronically, without the need for paper checks or cash. In this article, we will explore what ACH payments are, how they work, and the benefits of using them for bill payments.

What is an ACH Payment?

An ACH payment is a payment sent via the ACH (Automated Clearing House) network, an electronic network used to send paperless payments between bank accounts in the United States. ACH payments are typically used for recurring payments, such as utility bills, mortgage payments, and insurance premiums.

When you make an ACH payment, the funds are transferred directly from your bank account to the payee’s bank account. The ACH network acts as a intermediary, facilitating the transfer of funds between banks. The process is electronic, fast, and secure, making it a popular choice for bill payments.

How to Make an ACH Payment

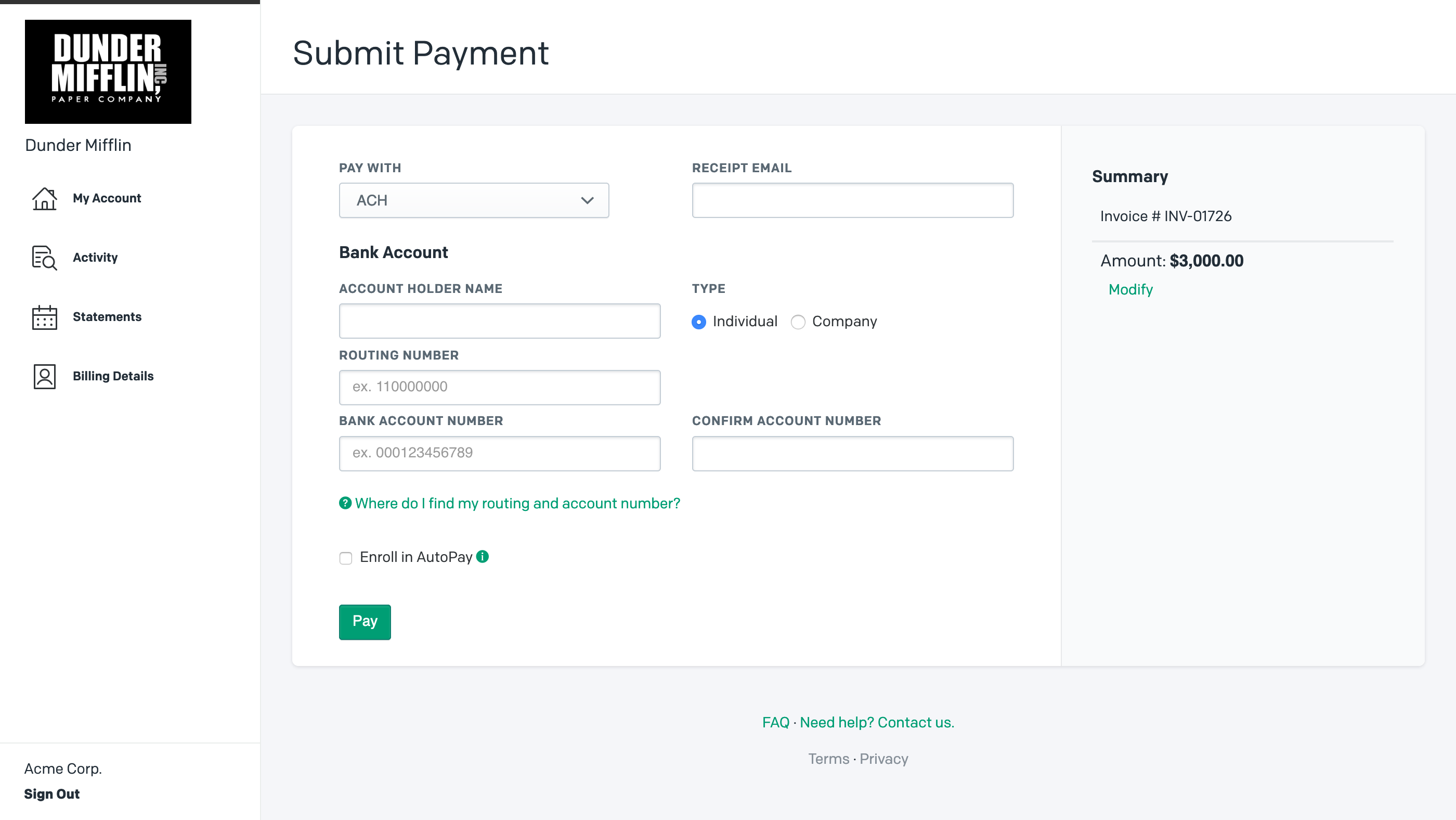

Making an ACH payment is relatively straightforward. Here are the general steps:

- Set up your account: To make an ACH payment, you’ll need to set up an account with a bank or financial institution that offers ACH payment services.

- Provide your bank account information: You’ll need to provide your bank account information, including your account number and routing number. This information can typically be found on your checks or by logging into your online banking account.

- Authorize the payment: Once you’ve provided your bank account information, you’ll need to authorize the payment. This involves giving permission for the payee to debit your bank account for the payment amount.

- Confirm the payment: After you’ve authorized the payment, you’ll need to confirm the payment details to ensure everything is accurate.

- Submit the payment: Once you’ve confirmed the payment details, you can submit the payment. The ACH network will then process the payment, and the funds will be transferred from your bank account to the payee’s bank account.

Benefits of ACH Bill Pay

There are several benefits to using ACH bill pay:

- Convenience: ACH payments are electronic, which means you don’t have to worry about writing checks, mailing payments, or manually transferring funds.

- Security: ACH payments are secure and tamper-proof, reducing the risk of fraud and identity theft.

- Speed: ACH payments are typically faster than traditional check payments, with funds available in 1-2 business days.

- Cost-effective: ACH payments are often less expensive than credit card payments, with lower fees and no interest charges.

- Easy to track: ACH payments are electronic, making it easy to track payment history and confirm that payments have been processed.

Conclusion

ACH bill pay is a convenient, secure, and cost-effective way to make payments electronically. By understanding how ACH payments work and the benefits they offer, you can enjoy the convenience of electronic payments for your recurring bills.

FAQ

What does ACH mean in bill pay?

How much does a ACH bill pay cost?

What is the difference between e payment and ACH payment?

Other Resources :

ACH Transfers: What Are They and How Do They Work?

An ACH payment is a payment sent via the ACH (Automated Clearing House) network, an electronic network used to send paperless payments between bank accounts in the United States. If you think of payments as the money taken out of your account when you have your monthly bills on autopay – that’s typically done via ACH.