May 18, 2023 · Get a free spreadsheet for bills to you track monthly bills, due dates, payments, balances, and more. Save money on interest and never miss

5 Free Spreadsheets for Bills to Track Payments and Due Dates

Introduction

Are you tired of manually keeping track of your bills and due dates? Do you find it challenging to remember which bills to pay and when? If so, a bill pay spreadsheet can be a game-changer for you. In this article, we will discuss how to use a bill pay spreadsheet to streamline your bill payment process and provide peace of mind. We’ll also explore the two top links returned by Google for the keyword search “bill pay spreadsheet,” which offer free spreadsheets for bills and bill tracking templates.

Why Use a Bill Pay Spreadsheet?

A bill pay spreadsheet is a simple yet effective tool that helps you track and manage your bills in one place. With a bill pay spreadsheet, you can:

- Keep track of all your bills and their due dates

- See at a glance which bills are overdue or upcoming

- Easily identify which bills have been paid and which haven’t

- Stay organized and avoid missed payments

- Save time and reduce stress by automating your bill payment process

Free Spreadsheets for Bills

If you’re looking for free spreadsheets for bills, there are several options available. Here are the two top links returned by Google for the keyword search “bill pay spreadsheet”:

- Tiller HQ – Free Spreadsheets for Bills

Tiller HQ offers a range of free spreadsheets for bills that are compatible with Google Sheets. Their bill payment tracker spreadsheet is highly visual and easy to use, making it simple to track past and future payments, see how much you owe, and pay each month. You can also prioritize payments based on interest rates to avoid excess interest payments.

[INST: Can you explain why it is helpful to have a bill pay spreadsheet that is compatible with Google Sheets?] Yes, having a bill pay spreadsheet that is compatible with Google Sheets can be incredibly helpful for several reasons. Firstly, Google Sheets is a free, web-based spreadsheet program that allows you to access your spreadsheets from any device with an internet connection. This means you can easily access your bill pay spreadsheet from your computer, tablet, or smartphone, making it easy to stay up-to-date on the go.

Secondly, Google Sheets offers a range of features that make it easy to collaborate with others. If you have a spouse or business partner, you can grant them access to your bill pay spreadsheet, allowing you to work together to track and manage your bills. This can help ensure that you’re both on the same page when it comes to your finances.

Lastly, Google Sheets integrates seamlessly with other Google tools, such as Google Calendar and Google Drive. This allows you to easily import your bill due dates into your calendar and store your spreadsheets in the cloud for easy access.

- Vertex42 – Bill Tracker Worksheet

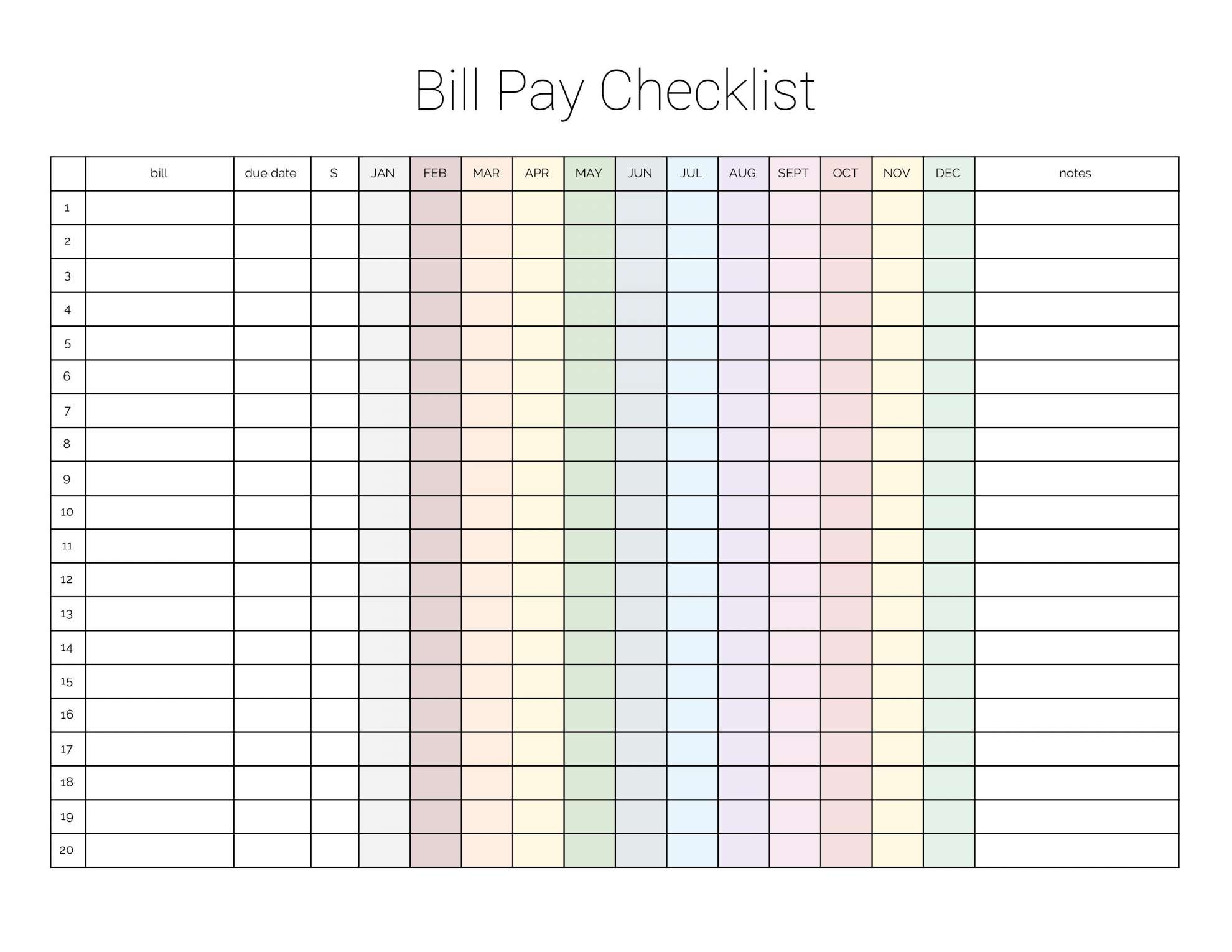

Vertex42 offers a free bill tracker worksheet that you can use to list all your recurring bills with their expected payment amounts. You can then check them off when they’re paid. This worksheet is useful for keeping track of your bills and can be printed out and included in your budget planner.

How to Create a Bill Pay Spreadsheet

Creating a bill pay spreadsheet is straightforward. Here’s a step-by-step guide to help you get started:

- Open a new spreadsheet in Google Sheets or Microsoft Excel.

- Create a list of all your bills, including the name of the bill, the due date, and the amount due.

- Set up a system for tracking payments, such as a checkbox or a column to record the payment date.

- Add a total column to calculate the total amount due and the total amount paid.

- Use conditional formatting to highlight overdue bills or bills that are almost due.

- Consider adding a budgeting column to track your expenses and stay within your means.

Tips for Using a Bill Pay Spreadsheet

Here are some tips for using a bill pay spreadsheet effectively:

- Set reminders for when bills are due to avoid missed payments.

- Use a consistent format for entering due dates to make it easy to read and understand.

- Consider using a separate sheet for each month to keep your spreadsheet organized.

- Use a budgeting column to track your expenses and stay

FAQ

How do I keep track of bills in Excel?

Other Resources :

May 18, 2023 · Get a free spreadsheet for bills to you track monthly bills, due dates, payments, balances, and more. Save money on interest and never miss