Log in to Online Banking and select the Bill Pay navigation tab. Select the biller for the eBill you wish to pay then enter the amount and choose the date you

Bill Pay & eBills FAQs

Introduction

Bank of America offers a convenient and secure way to pay bills online through their Bill Pay service. With Bill Pay, you can pay your bills on time, avoid late fees, and keep track of your payments. In this guide, we will walk you through the process of paying bills using Bank of America’s Bill Pay service.

Getting Started with Bill Pay

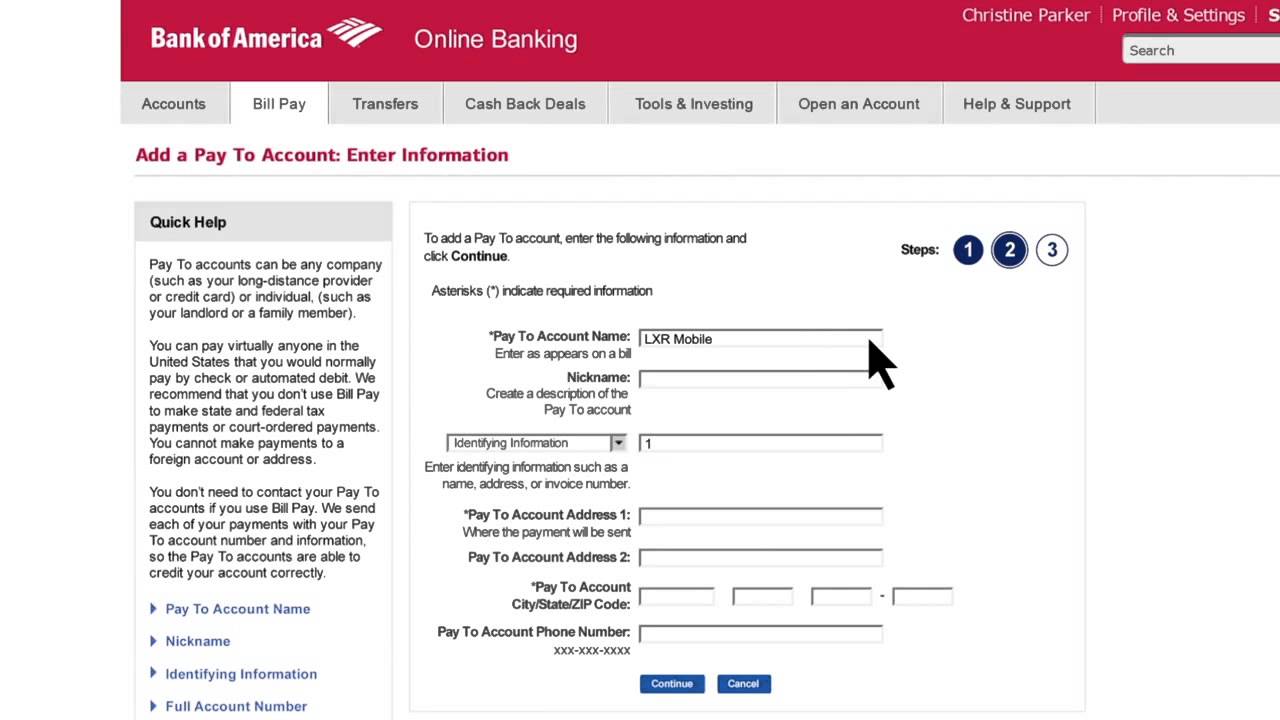

Before you can start paying bills, you need to enroll in Bank of America’s Online Banking. Once you have enrolled, log in to Online Banking and select the Bill Pay tab. You will be asked to accept the terms and conditions associated with using Bank of America’s online Bill Pay service.

To add a biller to your Bill Pay service, you will need copies of your bills. You can set up one-time payments, schedule future payments, or create recurring payments from your checking, money market savings account, SafeBalance Banking® account, or from your Home Equity Line of Credit.

Bill Pay FAQs

Here are some frequently asked questions related to Bank of America’s Bill Pay service:

- Q: How do I start using online Bill Pay?

A: First-time Bill Pay users will need to enroll in Online Banking and accept Bank of America’s Online Banking terms and conditions. Once you have enrolled, log in to Online Banking and select the Bill Pay tab (you will also be asked to accept the terms and conditions associated with using Bank of America’s online Bill Pay). At that point, you can start using the Bill Pay service right away. - Q: What is Bill Pay?

A: Bill Pay is an online service that allows you to pay your bills through Bank of America’s Online Banking. You can set up one-time payments, schedule future payments, or create recurring payments from your checking, money market savings account, SafeBalance Banking® account, or from your Home Equity Line of Credit. - Q: What are eBills?

A: eBills are electronic versions of paper bills. An eBill arrives from a biller into your Bill Pay account service the same way a paper bill arrives from a biller into your mailbox. Bill Pay allows you to view all your eBills—as well as account balances, transactions, and statement information—in one convenient place. You can also set up email notifications for when a new eBill arrives in your Bill Pay account. - Q: How long does it take for an online payment to reach a biller?

A: We recommend scheduling your payments to be made at least 5 business days prior to the actual payment due date on the bill. Scheduling your payments sufficiently in advance of the due date allows enough time for the biller to receive the payment and credit it to your account. - Q: Is there a fee for using Bill Pay through Bank of America?

A: No.

How to Pay an eBill

To pay an eBill using Bank of America’s Bill Pay service, follow these steps:

- Log in to Online Banking and select the Bill Pay navigation tab.

- Select the biller for the eBill you wish to pay.

- Enter the amount you want to pay and choose the date you want the payment to be received by the biller.

- Confirm the payment details and submit the payment.

You can also choose from a variety of automated payment options, including payment to arrive on the due date, payment made upon the receipt of the eBill, and payment to arrive before the due date based on the number of days you choose.

Managing Your eBills

You can view all your eBills in the Incoming eBills section of the Bill Pay page and on the eBills overview page in Online Banking. You can also set up email notifications for when a new eBill arrives in your Bill Pay account.

To cancel an eBill, log in to Online Banking and select the Bill Pay navigation tab. Select the biller for the eBill you wish to cancel, then select the Edit eBill options link and click the Cancel eBill link.

Conclusion

Bank of America’s Bill Pay service offers a convenient and secure way to pay your bills online. With this comprehensive guide, you should now have a better understanding of how to get started with Bill

FAQ

Does Bank of America bill pay send a check?

What does a bill pay check look like?

Does bill pay send a bank check?

What is the limit for Bank of America bill pay?

Other Resources :

Log in to Online Banking and select the Bill Pay navigation tab. Select the biller for the eBill you wish to pay then enter the amount and choose the date you