Pay your bills online and stay on top of your finances. The PayPal app lets you pay and manage bills all from one, secure place. Get started today.

Manage and Pay Your Bills Online

Introduction

PayPal is a convenient and secure way to pay bills online. With a PayPal account, you can link, pay, and manage your bills from the PayPal app or website. In this article, we will guide you through the process of paying bills with PayPal and answer some frequently asked questions.

Paying Bills with PayPal

To pay bills with PayPal, follow these steps:

- Log in to your PayPal account on the app or website.

- Click on “Pay Your Bills” or “Manage Money.”

- Search for your biller, and if you’ve previously added a biller, click “Add a New Bill” first.

- Select your biller and enter your bill account details.

- Click “Add Your Bill.”

- Review the bill details and click “Pay.”

- If prompted, enter the payment amount, and click “Next.”

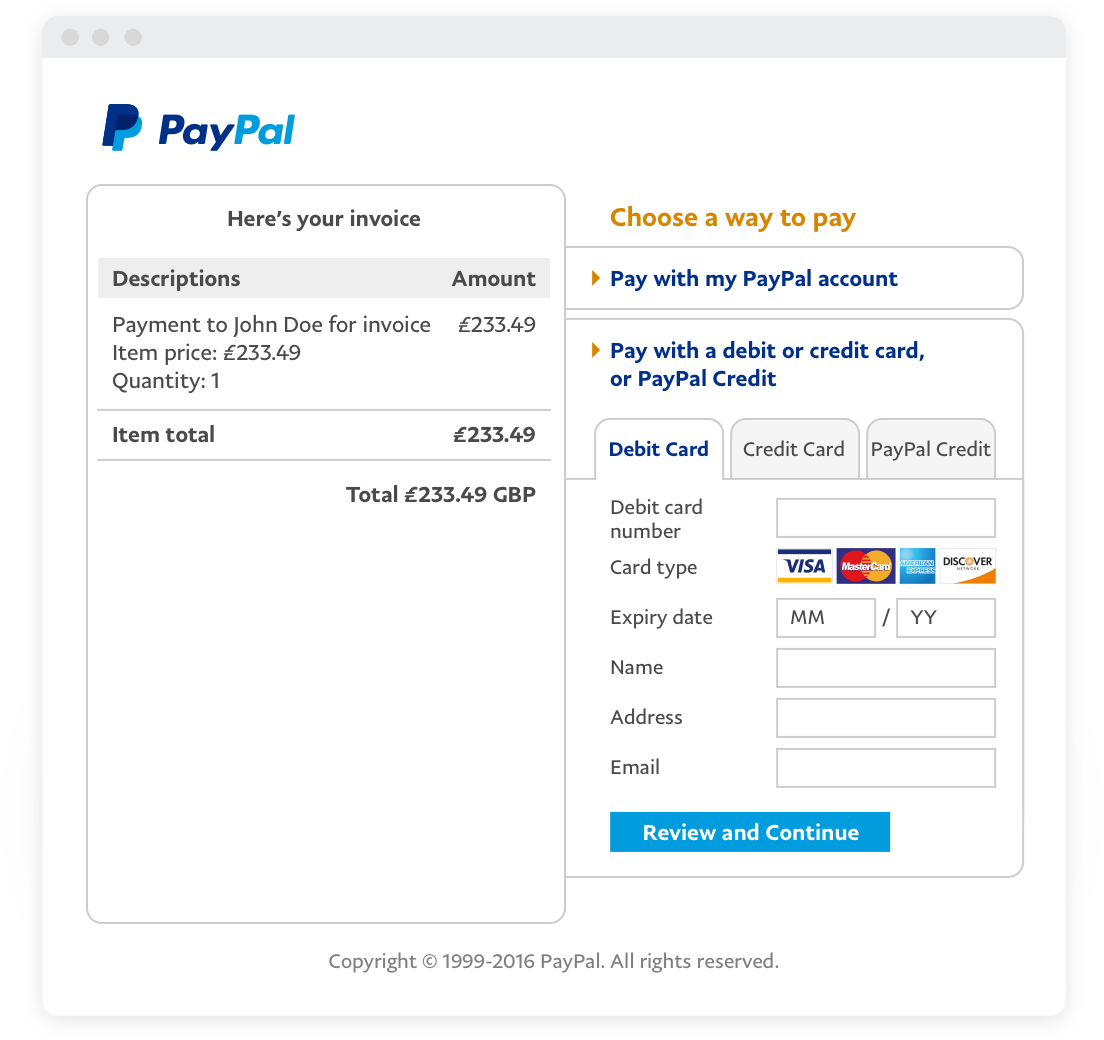

- Select your payment method and payment date.

- Click “Send Payment” or “Schedule Payment” for a future payment.

Frequently Asked Questions

- Can you pay bills with PayPal?

Yes, you can link, pay, and manage your bills from the PayPal app or website. - What bills can I pay with PayPal?

You can pay various bills using PayPal, such as power, water, cell phone, subscription services, and more. - Why can bills show as unpaid or overdue if they’re paid through another channel?

When you pay your bill using another method other than PayPal, it can take some time to reach our system. Once your payment posts in the PayPal network, the bill will show as “paid” and you can disregard the overdue notice. - Why can there be late fees when you pay your bill on time?

Depending on the biller, your balance may not be considered paid until 5 days after you paid it. You can even request a correction or a late fee refund. Contact your biller for details about late fees.

Managing Your Bills with PayPal

PayPal offers a convenient way to manage your bills. Here are some features that can help you stay on top of your subscriptions and payments:

- Payment Reminders: PayPal sends reminders when your bills are due, so you’ll never miss a payment.

- Auto-Pay: You can set up automatic payments for your bills, so you don’t have to worry about missing a payment.

- Payment History: You can view your payment history, including past due dates and amounts.

- Multiple Payment Methods: You can link multiple payment methods, such as bank accounts, debit or credit cards, and PayPal Credit, to your PayPal account.

- Subscription Management: You can manage your subscriptions and turn them on or off with just a few clicks.

Conclusion

Paying bills with PayPal is a convenient, secure, and easy way to manage your finances. With the ability to link, pay, and manage your bills from the PayPal app or website, you’ll never have to worry about missing a payment again. If you have any questions or concerns, you can contact PayPal’s customer support team for assistance.

FAQ

How much does PayPal charge for bill pay?

Can you pay credit card bills with PayPal?

Can I pay my mortgage with PayPal?

Other Resources :

Can I pay my bills with PayPal?

Pay your bills online and stay on top of your finances. The PayPal app lets you pay and manage bills all from one, secure place. Get started today.