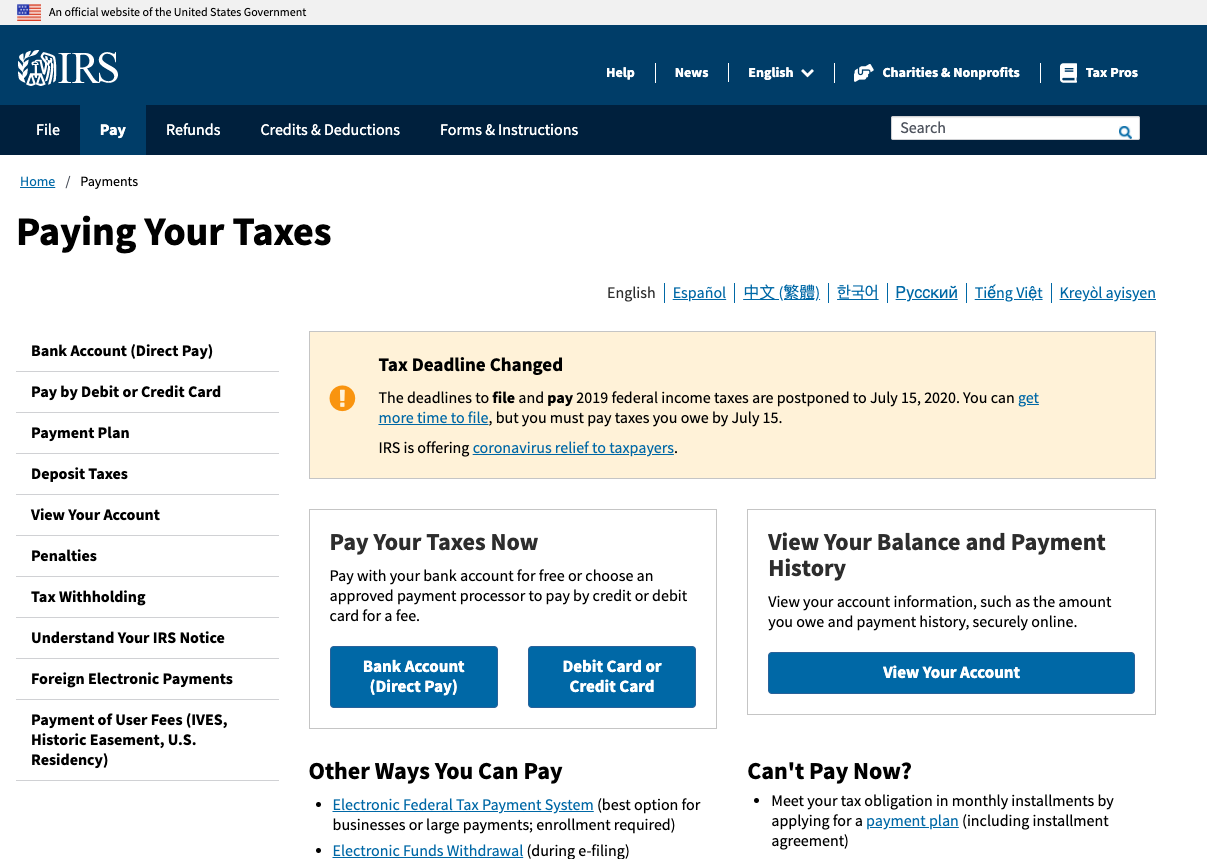

· You’ll need to confirm your identity before making a payment using pay now options. Make a payment today, or schedule a payment, without signing up for an IRS …

Payments | Internal Revenue Service

Are you looking for a hassle-free way to pay your IRS bill? Look no further! In this article, we will provide you with all the information you need to make your IRS bill payment process smooth and efficient. From various payment options to contact details, we’ve got you covered. Let’s dive in!

Introduction: Simplifying the IRS Bill Payment Process

Paying your IRS bill doesn’t have to be a daunting task. With the right information and resources, you can easily navigate through the payment process. The Internal Revenue Service (IRS) offers several convenient options for individuals and businesses to make their tax payments. Whether you prefer online payments, debit/credit card payments, or even digital wallets, the IRS has got you covered.

Link for Easy Bill Payment

To help you with your IRS bill payment, we found a helpful link on the official IRS website. This link provides a secure and user-friendly service that allows you to pay your tax bill or make estimated tax payments directly from your checking or savings account, at no cost to you [1]. This service ensures a seamless payment experience, allowing you to focus on other important aspects of your financial obligations.

Convenient Payment Options

The IRS offers a range of payment options to suit your preferences and needs. Here are some of the most commonly used methods:

-

Pay from Your Bank Account: Individuals can schedule payments up to a year in advance directly from their bank account, without any registration or fees from the IRS. This option provides flexibility and convenience [1].

-

Debit Card, Credit Card, or Digital Wallet: Both individuals and businesses can make payments using their debit card, credit card, or digital wallet. While processing fees apply, this option offers a quick and secure way to settle your IRS bill [1].

Contact Information

In case you need further assistance or have specific inquiries regarding your IRS bill payment, here is the contact information you may find helpful:

- Phone Number: You can reach the IRS at their toll-free number: 1-800-829-1040 [2].

- Email: For general inquiries, you can email the IRS at their official email address: [email protected] [2].

- Address: If you prefer traditional mail, you can send your correspondence to the following address: Internal Revenue Service, 1111 Constitution Avenue NW, Washington, DC 20224 [2].

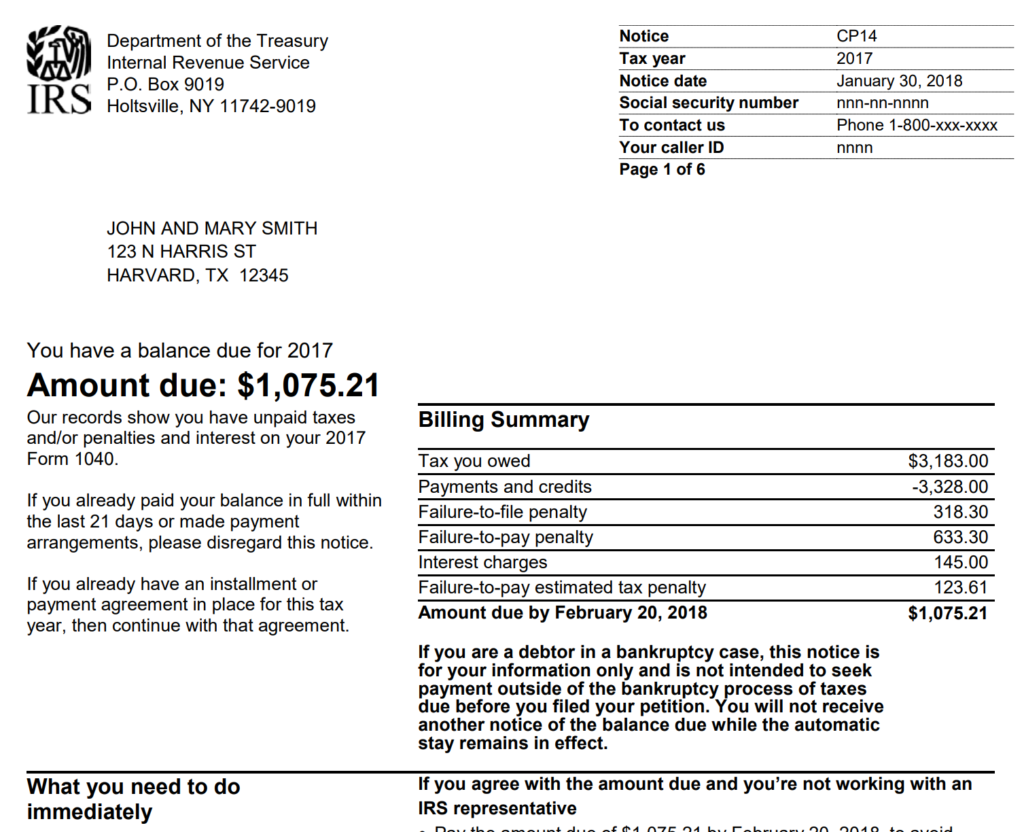

Late Payments and Payment Extensions

Sometimes, unforeseen circumstances may lead to late payments or the need for a payment extension. If you find yourself in such a situation, it’s important to know your options. The IRS provides assistance in these cases, allowing you to request a payment extension or set up a payment plan, such as an installment agreement, if you are unable to pay your taxes in full [2].

Additional Information

Here are some additional resources and information that may be helpful:

- Payment Reminder Notice: If you are unsure about the tax year for which you are making a payment, refer to the payment reminder notice you received. It will provide guidance on the appropriate tax year to choose [3].

- Multiple Tax Years: If you need to make payments for multiple tax years that are not associated with an installment agreement, it is recommended to submit separate payments for each tax year [3].

Remember, staying informed and utilizing the available resources can make your IRS bill payment process much smoother.

Learn more:

FAQ

How do I pay my IRS bill?

If you owe taxes, the IRS offers several options where you can pay immediately or arrange to pay in installments: Electronic Funds Withdrawal. Pay using your bank account when you e-file your return. Direct Pay. Pay directly from a checking or savings account for free. Credit or debit cards.

Where can I find my IRS bill?

Individual taxpayers can go to IRS.gov/account to securely access information about their federal tax account. They can view the amount they owe, access their tax records online, review their payment history and view key tax return information for the most recent tax return as originally filed.

How do I find out how much I owe the IRS?

Individual taxpayers can go to IRS.gov/account to securely access information about their federal tax account. They can view the amount they owe, access their tax records online, review their payment history and view key tax return information for the most recent tax return as originally filed.

What is the best way to pay my taxes?

The fastest and easiest way to make an estimated tax payment is to do so electronically using IRS Direct Pay or the Treasury Department’s Electronic Federal Tax Payment System ( EFTPS ). For information on other payment options, visit IRS.gov/payments. If paying by check, be sure to make the check payable to the “United States Treasury.”